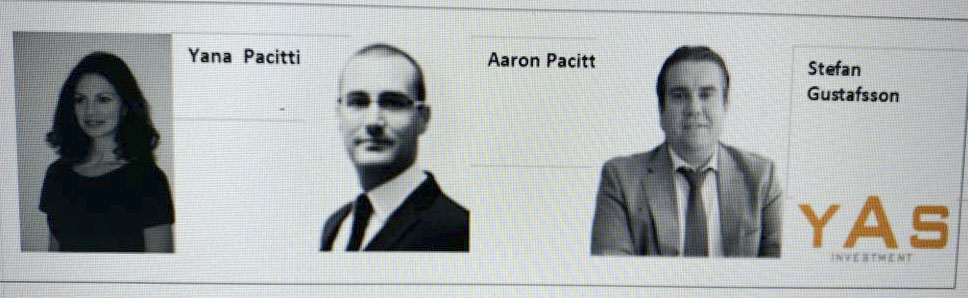

#1 - YAS, the Investment Advisor and Sponsor of Columna Commodities Fund

Yana Pacitti, Aaron Pacitti, Stefan Gustafsson |

- Aaron Pacitti and Stefan Gustafsson joined forces in June 2012 to launch Columna fund.

- YAS Investment set up in Luxembourg in March 2013, comprising Yana Pacitti, Aaron Pacitti, Stefan Gustafsson - Y-A-S.

- Columna Commodities launched in August 2013, Global Hill Corporation registered in Hong Kong September 2013. 2 Pacittis and Gustafsson are directors, no LFP representation!

- August 2014 Bizzarri's Bstar pledges its shares to Global Hill Limited in HK, not Global Hill Corporation, therefore void!!

- In 2015 APWB Trading DMCC in Dubai set up to market Columna, by Aaron Pacitti and Rhys Harriott. Warren Macal, a Pacitti colleague, also markets Columna.

- In late 2015 Pacitti, Harriott, Anuj Ghosh market direct loans to BStar for up to 40% commissions to placement agents.

- In late 2016 Columna collapses, with US$ 55 million lent to Global Hill Corporation unaccounted for...

- Aaron Pacitti's swiss-based colleague Walter Bizzarri, both with Russian wives and cross-godfathers, presents BStar to Columna to receive funding.

- In 2015 APWB Trading DMCC in Dubai set up to market Columna, by Aaron Pacitti and Rhys Harriott (APWB = A Pacitti, W Bizzari).

- In October 2015 Bizzarri transfers BStar ownership into his own name.

- In September/October 2016 Global Hill transfers via SocGen US$ 9 million to Bizzarri's companies in Slovakia (not Switzeerland as approved!).

- June 2018 BStar declared bankrupt in Switzerland with chf 50 million of losses for Columna.

- Stefan Gustafsson's swedish colleague in Spain, Karen Hedenquist, sets up Megahan House in Hong Kong in February 2013, Pyxus Refinery set up in Spain in May 2013.

- Megahan loan balance €410,000 (balance could be higher, SocGen bank statements not available!!)

- Pyxus loan balance €2,975,000 (balance could be higher, SocGen bank statements not available!!)

- Hedenquist resigns from Pyxus in April 2016, resigns from Megahan in May 2016.

- In late 2016 Columna collapses, with €3.3 million from Megahan and Pyxus unaccounted for..

The Fraud Facilitators - without whose help Columna's money would never have been lost!

Sometimes financial entities expose a fund to fraud possibilities without being the direct beneficiary. Their actions create the opportunity for fraud, and then of course actively engage in cover up when the fraud is committed.

#1 - CSSF, the Luxembourg financial regulator

- Married Apex (the fund administrator) to Luxembourg Fund Partners, thus created the conflict of interest in NAV calculations.

- Approved a fund where neither the directors, the investment mamager nor the investment advsiors had any asset class investing experience whatsoever!

- Granted a newbie fund with zero experience 3 years carte-blanche re. non-diversification. In 3 years and 1 day almost 90% of Columna was lost with Walter Bizzarri's group of companies.

- Refused to force a regulated entity, SocGen, to provide historic bank statements, thus abetting the covering up of fraud and money laundering.

- Refused to force a regulated entity, Alter Domus Management, to provide historic fund documents, thus abetting the covering up of fraud and misdealings.

- Refused to provide the investigating director with the previous directors' replies to CSSSF enquiries into lack of diversification, use of +HK companies etc..

- Ignored shareholder complaints and requests for help, citing that as "Well-informed Investors" under the SIF Law, basically "tough luck!!" - notwithstanding the widescale fraud that had occurred under their watchful eye..

- Was aware from April 2013 that Apex owned 18% of Luxembourg Fund Partners, yet never once alerted investors to this clear conflict of interest in the annual reports.

- Failed to spot that BStar loan servicing only happened a few days after each new BStar capital drawdown, for 3 years.

- Failed to note that investments in BStar were actually being sent to an unauthorised UK subsidiary, Swiss Asset Management.

- Failed to comment on the lack of any LFP I control or director representation in Columna of Hong Kong 100% subsidiary, Global Hill Corporation.

- Took over as Custodian Bank to Columna in March 2015, yet allowed Global Hill to bank with former custodian ABN Amro without consolidating control.

- Resigned as Custodian Bank in June 2016, with 3 months notice, yet afterwards transacted 8 rapid payments each of approx. US$ 1 million to unauthorised Walter Bizzari companies in Slovakia (meant for Switzerland).

- Instructions for these 8 payments were to IBAN's in Slovakia for Slovakian companies with same name as Columna approved entities in Switzerland with Swiss IBAN's.

- Instructions for these payments were given by Global Hill to SocGen, with banking officer name deleted and hand-written fax number, suggesting internal complicity in fraud.

- A total of US$ 8.95 million was transferred to Slovkian unauthorised entities by SocGen in Sept./Oct. 2016, after they had resigned and notice period lapsed as custodian bank. This US$ 8.95 million was never recovered!!

- Effectively an Organised Financial Crime Group, operating at least 4 Ponzi schemes in LFP I, plus similar losses in LFP Prme, and Alliance Omnibus Property

- Primarily owned by LFP directors Luc Leleux and Julien Renaux, then 18% shareholder Apex from April 2013.

- Shared 2 directors, and same office floor with Apex at 11 Boulevard de la Foire in Luxembourg, zero independence of administrator and investment manager.

- Ceded lack of transparency to 100% subsdiary Global Hill Corporation in Hong Kong, with no director representation or bank account signing power.

- Allowed 3 YAS Investment Advisors, the 3 directors of Global Hill, with zero commodities investment experience, to completely access and manage Columna monies.

- Sold to Alter Domus Group at end of 2017

- Refused to hand over historic fund documents to investigating new director David Mapley in December 2018, sued in Luxembourg courts, case still not resolved as at November 2023!!

- Architects of the entire LFP Organised Financial Crime Group, with LFP I, LFP Prime, and Alliance Omnibus Property group of funds.

- Also controlling directors of investment manager Luxembourg Fund Partners.

- Directors' names removed from www.columnafund.com in July 2016, 4 months before Columna's collapse.

- Apex owned 18% of Luxembourg Fund Partners, from April 2013 - an undisclosed conflict of interest re monthly NAV share price calculation.

- Apex provided a managing director to Luxembourg Fund Partners, Christophe Lentschat, involved in the day-to-day running of Columna

- Apex provided a second director to Luxembourg Fund Partners, Peter Hughes, the global CEO of Apex Group

- Strangely, Apex operated in Luxembourg through the branch of Apex Malta, which somehow failed to raise any suspicions.

- The CSSF arranged the Apex shareholding and management involvment in Luxembourg Fund Partners in order to grant Luxembourg Fund Partners a funds management licence.

- Christophe Lentschat resigned as managing director of Luxembourg Fund Partners in January 2016, Peter Hughes resigns as director in December 2016.

The "Failed" Service Providers

#1 - ABN Amro, Custodian bank to Columna and Global Hill in Hong Kong- Custodian Bank to Columna from August 2013 to March 2015, allowed US$ 47 million investments to be transferred to unauthorised entity Swiss Asset Manager in the UK.

- Resigned as Custodian Bank in March 2015, yet continued to provide banking to Global Hill Corporation in Hong Kong, weakening control of Columna management.

- Despite Swiss Asset Manager changing bank account twice in 6 weeks in late 2015, failed to spot the change of ownership from 100% BStar now into private hands of Walter Bizzarri, despite it being a public record in the UK.

No comments:

Post a Comment